Cement scarcity hinders GDP development in quarters.

- Category: General

- By Admin

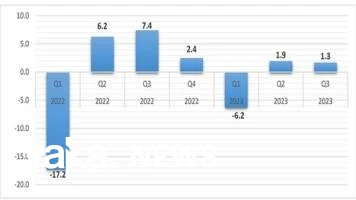

According to official data, Zimbabwe's economy saw a slowdown in the third quarter of last year due to the sector's 36.7% decline, which was mostly caused by the country's pervasive cement shortages during that time. According to the Zimbabwe National Statistics Agency (ZimStat), based on 2019 constant prices, the GDP growth rate for the third quarter of 2023 was predicted to be a meager 1.3 percent. Overall, El Niño-related drought is predicted to lead Zimbabwe's economic growth to drop to 3,5 percent in 2024 from 5.5% this year, according to Minister of Finance, Economic Development, and Investment Promotion Professor Mthuli Ncube's remarks on Thursday. Crop yields are predicted to be negatively impacted by El Niño, a natural climate event that occurs when the surface waters of the central and eastern Pacific get exceptionally warm and alter global weather patterns. This will happen in 2023–2024. The change in gross value added between successive quarters is evaluated by the quarter-to-quarter growth rate. In terms of constant 2019 pricing, the value for the third quarter of 2023 was $58,3 billion, or $41 trillion when adjusted for inflation. According to ZimStat, the 2019 constant prices do not account for variations in the inflation rate, which has been a recurring aspect of Zimbabwe's economy in recent years. Following nearly ten years of hyperinflation, the nation in Southern Africa adopted a US dollar-dominated currency basket in 2009 and returned its own currency to the US dollar in February 2019. Construction value added is calculated using the combined index of domestically and import-produced cement, according to ZimStat. The third quarter of the year saw an almost 100% increase in cement prices in Zimbabwe, which prompted the government to grant import licenses to traders in order to address the shortage in supplies. With a combined capacity of roughly 2,6 million tons yearly, local producers PPC Zimbabwe, Khaya Cement, and Sino Zimbabwe Cement were unable to meet national demand for a variety of reasons, including planned maintenance schedules and plant breakdowns. According to ZimStat, cement is a coincident indication of construction activity. "The industry saw a 36.7% decline in the third quarter of 2023, primarily due to shortages of cement and comparatively higher cement prices during the quarter." A few other important industries that hindered growth during the quarter were mining and quarrying operations, housing and food services, human health and social work activities, and agriculture. ZimStat reported that "seasonal patterns, wherein a limited number of crops were harvested during the third quarter of 2023, caused the agriculture industry to record a decline of 14.5 percent." The third quarter saw a 2,4% decrease in industry output, mostly as a result of lower production of iridium (33,5%), coal (29,6%), diamonds (14%) and chrome (9,8%). The industry's overall performance suffered as a result of these production shortages. During the third quarter of 2023, the transport sector was one of the growth drivers, with a growth rate of 27,4%. The increased flow of manufactured commodities, minerals, and agricultural products was the main driver of this rise. Other significant GDP contributors included information and communication, which increased by 33.9% due mostly to the nation's growing use of technological solutions. The industries of water supply, sewage, waste management, and remediation activities saw an increase of 41,9% from quarter to quarter. The reason for this increase is that the quarter is the driest time of year, which means there is a greater need for raw and treated water for irrigation and other necessities. The third quarter saw a 12.7% increase in power output, a crucial measure of the value-added of the electrical sector. ZimStat stated that the increased electricity generated from Hwange Units 7 and 8 is the reason for this growth. The value added of a given quarter is compared to the value added of the same quarter the previous year to determine the year-over-year quarterly growth rate. This measure shows the economy's growth or contraction over a 12-month period. The third quarter's year-over-year quarterly growth rate is expected to be -0.8, which indicates a decline from the same quarter the year before.