WestProp plots mega capital raise

- Category: Real Estate

- By Dion Kajokoto

WestProp Holdings Limited, which is listed on the VICTORIA Falls Stock Exchange, is in talks with "several parties" to assure the success of another capital issue scheduled within the next three months to advance its initiatives. The negotiations come a year after an initial public offering (IPO) raised just a tenth of the minimum amount when stockholders subscribed to preference shares worth US$3.3 million out of the US$30 million on offer. WestProp CEO Ken Sharpe told NewsDay Business that the company is "getting ready" for another capital round.

He said the lesson from last year was that WestProp was meant to do a book-building exercise to pique the market's interest in the IPO. Sharpe described the book building operation as a pre-marketing of the capital issue "to ensure that the market has an appetite and the capacity to fund the amount that you require." "We're in talks with numerous parties. We anticipate an announcement of a large capital raise deal in the next two to three months, which will dramatically alter the company's direction. "We're currently doing those book building exercises," he stated.

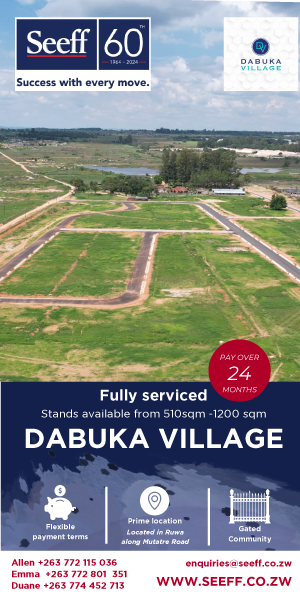

WestProp began construction on the US$300 million mixed-use Hills Luxury Golf Estate last week, as its urban regeneration effort accelerates. Its other active projects include Millennium Heights, Pokugara Residential Estate, Pomona City, The Mall of Zimbabwe, and Millennium Heights Office Park.

WestProp executives recently went on a roadshow in the United States to increase interest in their projects. Sharpe saw it as an important time to announce a development in Zimbabwe similar to the Hills Estate in Washington, the world's "capital". "I felt gratified that we, as Zimbabweans, could do things that were appreciated by the international community. "In the capital city of one of the world's powerhouses and announcing that Zimbabwe was going to be doing something exceptional, something that is a game changer, something that raises the bar, for me was humbling," he stated.

"This gave me faith that this is neither the first nor the last roadshow that we will hold in the diaspora. Our brothers and sisters have access to billions of dollars in the United States. That's enough money to reconstruct our country." Sharpe stated that while overseas financiers can come on board, it would be more thrilling if "Zimbabwean brothers and sisters" took money from their pockets and sent it home. "As WestProp, we are prepared to create the country together, and we know that with their support, it will be lot faster. We have multiple people committed to the idea from that event, and we will continue to hold roadshows," he stated.

He did, however, lament the absence of mortgage facilities by banks, which he claimed was unusual for any country. "We are not a bank, yet our mortgage book of US$24 million is expanding to US$30 million, which is more than any bank in Zimbabwe; this is neither natural or possible. Why aren't banks offering mortgages? "Why aren't they tapping into international markets for mortgage-backed securities that could be transferred to Zimbabwe? Although sanctions have been lifted, they are ineffective. "My message to them is to be more active," he stated. Sharpe stated that the central bank could lend the statutory reserve to commercial banks at concessionary rates for lending to the real estate and manufacturing industries, among others, because "we know we are productive".

The central bank recently upped statutory reserves to 20% from 15%. "We won't spend that money. We intend to invest in long-term infrastructure that will benefit our country and add value. "And when we do that, the economy grows," he stated.