Unlocking Zim’s expansive infrastructure potential through REITs

- Category: Construction

- By Dion Kajokoto

Zimbabwe, like many other poor countries, has enormous difficulties in managing and financing infrastructure projects. In light of resource constraints and the requirement for significant infrastructure development, it becomes essential to investigate alternate funding strategies. Through the use of Real Estate Investment Trusts (REITs), Zimbabwe can effectively involve both the public and private sectors in the financing and administration of infrastructure projects. This article explores Zimbabwe's potential to use REITs as a tool for infrastructure development and promote collaborations between the public and private sectors, learning from other countries' experiences.

We can pinpoint crucial tactics for effective implementation in Zimbabwe, opening the door for long-term, sustainable economic growth and development, by looking at important actions made by other countries. The construction of infrastructure is essential to both societal advancement and economic expansion. Large-scale infrastructure project funding and management, however, present serious difficulties for many governments, especially those in developing countries like Zimbabwe. Implementing crucial infrastructure projects is frequently hampered by limited budgetary capacity, as well as restrictions on obtaining international financing, regulations, and resources. Given these obstacles, investigating creative funding methods becomes essential.

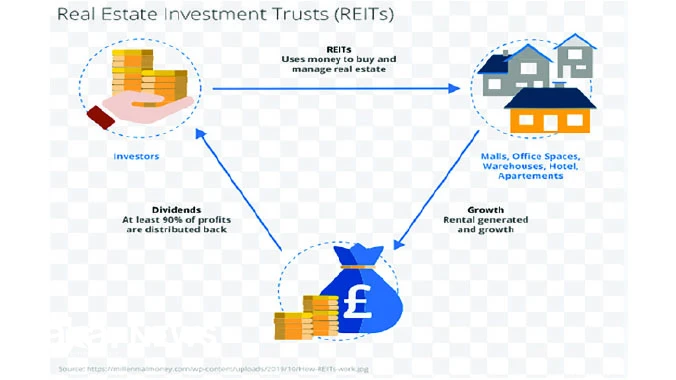

REITs are becoming a competitive international option for funding infrastructure projects. In order to invest in income-producing real estate assets and provide a consistent income stream, REITs combine investor capital. There are many advantages to using REITs for infrastructure construction, including as improved project management, risk diversification, and access to financing markets. This article examines how Zimbabwe might work with the public and private sectors to create partnerships in order to leverage the potential of REITs to address its infrastructure needs.

A REIT is a business that invests in, manages, or funds income-producing real estate in a variety of real estate markets. Without taking direct ownership, investors can participate in a diverse portfolio of real estate assets through REITs. Given that Zimbabwe is required to pay out a sizable amount of its earnings as dividends, its investments are appealing because of their high 80 percent dividend yields. Traditional real estate investment trusts that were founded in the US in the 1960s were the ancestors of infrastructure REITs. Infrastructure Real Estate Investment Trusts (REITs) became a thing as investors started looking for steady revenue streams and diversification over time.

Typically, these REITs make investments in infrastructure related to energy, transportation, water, and communication that is necessary for society to function. REITs can produce significant cash for infrastructure projects by combining funds from a variety of investors, including pension funds, retail investors, institutional and individual investors, and so on. These initiatives may involve modernizing already-existing infrastructure as well as greenfield ventures. Regulations, market dynamics, and shifting investor preferences have all had an impact on the development of infrastructure REITs. Investor interest in infrastructure assets as a way to produce consistent profits has increased along with the growth in the world's infrastructure needs.

As a result, specialized infrastructure REITs that focus on particular industries or geographical areas have been created. The creation of infrastructure based on REITs has enormous potential in Zimbabwe's real estate market. The need for residential and commercial real estate as well as infrastructure assets is rising, and REITs offer a great chance to draw in capital. Zimbabwe is also more appealing to investors looking for long-term gains because of its advantageous position and plenty of natural resources.

In addition, REITs offer transparency and liquidity, which are critical for luring investment in infrastructure projects. Investors benefit from regular income distributions and the potential for capital appreciation, while the underlying assets provide a tangible value proposition. Zimbabwe can tap into a wider pool of investors by structuring infrastructure projects as REITs, reducing reliance on traditional sources of financing and mitigating risks associated with project finance.

Zimbabwe can promote investor trust in the real estate industry by improving market liquidity and facilitating price discovery through the listing of infrastructure REITs on stock markets. Effective collaborations between the public and private sectors are necessary for the successful execution of REIT-based infrastructure projects in Zimbabwe. Government agencies, financial institutions, regulatory authorities, and real estate developers must work together to guarantee industry standards are met, get past regulatory roadblocks, and expedite project approvals.

While the public sector offers policy assistance, regulatory monitoring, and infrastructure planning, the private sector contributes experience in project development, funding, and management. Zimbabwe can foster an atmosphere that is favorable to REIT infrastructure investments by utilizing the advantages of both sectors. International experiences provide important perspectives on how to create public-private partnerships (PPPs) for REIT-based infrastructure development. Infrastructure projects based on REITs have been implemented effectively in nations like Singapore, Australia, and the US, proving the usefulness of this financing model in a variety of situations.